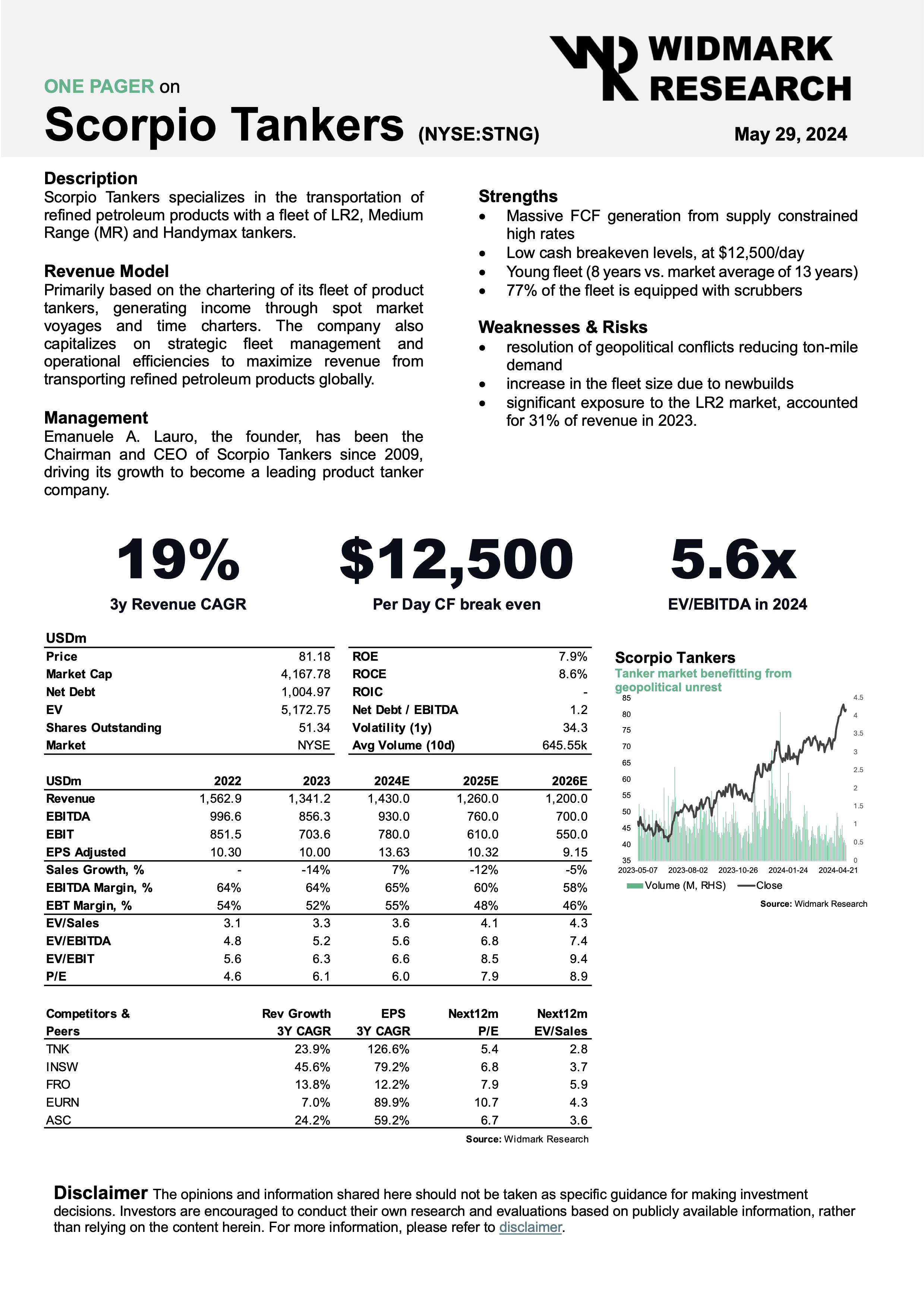

Scorpio Tankers: Primed to profit from geopolitical turbulence

With surging geopolitical tensions and years of deleveraging, Scorpio Tankers is primed to gain, now heading for over $1B in CF in 2024. But after a 70% rally, timing is tricky.

The rise in freight rates driven by ongoing geopolitical tensions, weather disruptions, and dislocated refineries has propelled Scorpio Tankers (NYSE: STNG) back to levels last seen 2011-2015.

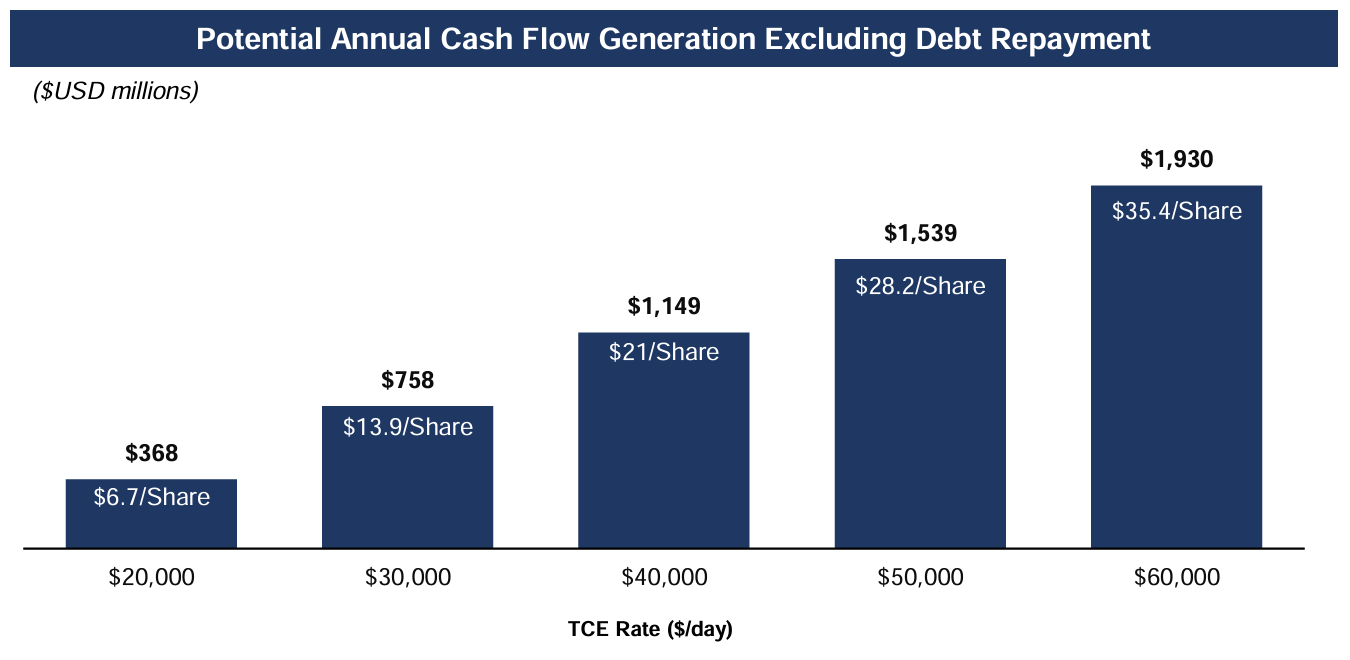

Given the current constrained supply environment and lower cash breakeven levels, STNG is poised to generate massive free cash flow. With an estimate for average rates of $40,000 per day in 2024 and cash break even at $12,500 per day after a $224m debt prepayment in May, STNG is set to produce FCF over $1 billion in 2024. This could be allocated towards further deleveraging, dividends, and share repurchases. However, we also note significant newbuilds, particularly LR2 tankers, entering the market next year, potentially putting pressure on freight rates. Nonetheless, the potential for scrapping of aging fleets should help offset fleet growth.

Established in 2009, Scorpio Tankers specializes in the transportation of refined petroleum products. Starting with just three Panamax tankers, the company expanded rapidly, notably through its Newbuilding program and acquisitions like Navig8 Tankers in 2017 and Trafigura's subsidiaries in 2019, reaching a fleet of over 130 vessels at its peak.

In Q1'24, STNG sold two MR product tankers for $39m and $36m respectively. In March 2024, STNG also agreed to a 2013 built MR product tanker, STI Le Rocher, for $36.2m, and in April 2024, STNG sold a 2015 built MR product tanker, STI Manhattan, for $40.8m.

Currently, Scorpio's fleet comprises 109 vessels, including 39 LR2, 56 Medium Range (MR), and 14 Handymax tankers.

Geopolitical unrest and increased polarization

After four years of consecutive losses due to a low earnings cycle, STNG returned to profitability in 2020, driven by strong demand for tankers as floating storage. The stock price surged during the EU sanctions against Russia and the Red Sea crisis, which inflated tanker earnings significantly. Despite this, STNG shares have not yet reached par with NAV, primarily due to issuance of shares and convertible notes.

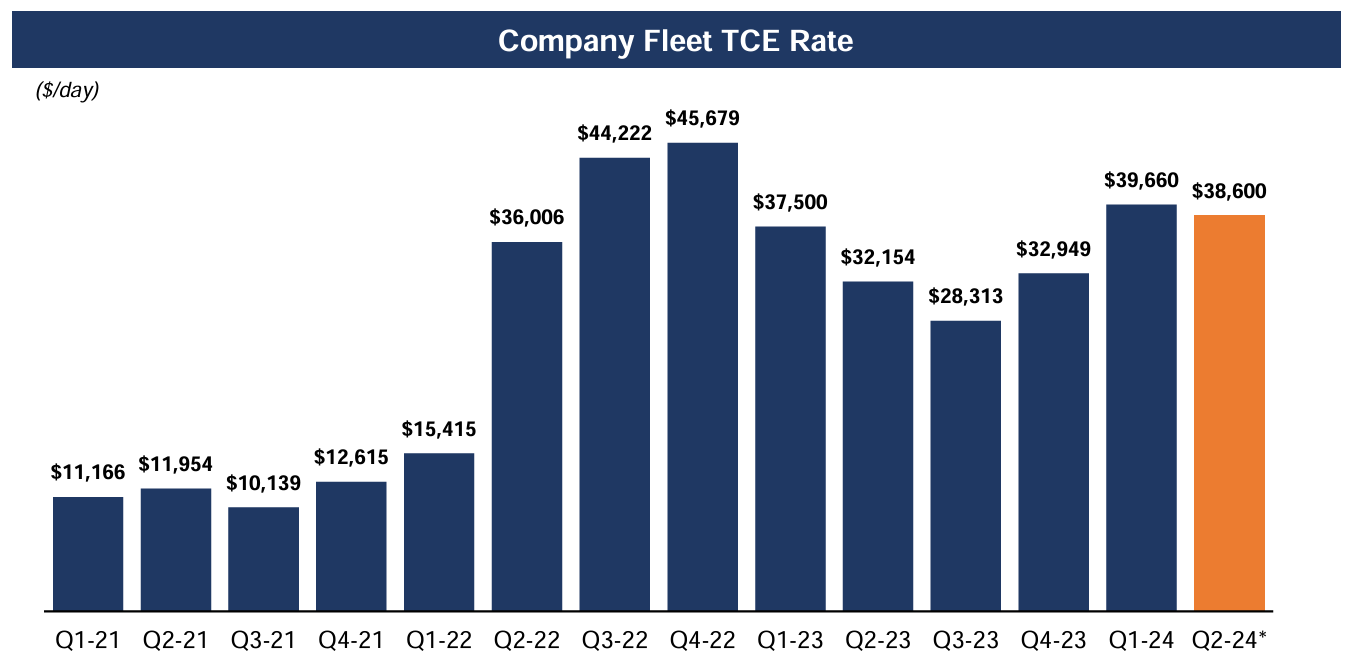

The market has seen a significant increase in product tanker rates since Q1-22. There is a robust product demand and low inventories which has led to record levels of seaborne exports. So far there has been a limited fleet growth with low orderbook and aging fleet. But this is about to change in 2025. But for now, seaborne exports and ton mile demand expected to outpace supply in the near term.

One of the key factors behind the increase in product tanker rates has been shipowners avoiding passing through the Suez Canal due to the Red Sea crisis. What would typically be a 22-day trip from the Arabian Gulf through the Suez Canal is now instead a 38-day journey through the Cape of Good Hope in South Africa. According to BIMCO, as tankers are increasingly re-routed to the Cape of Good Hope, the ton-mile demand for product tankers increased 13% (Y/Y) in 1Q24.

Importantly, global refining capacity has also shifted from the US, Australia, and Europe to China, India, and the Middle East. This shift has increased the distance between supply and demand, driving up shipping capacity usage and rates.

Substantial cash flow generation with a cash break-even at $12,500 per day

In Q1 2024, STNG reported average rates just shy of $40,000/day.

STNG has significantly reduced its debt from $3.2 billion in 2021 to below $1.4 billion as of May 2024. Net debt is now below the company's target range of $850-$900 million, aligning with the scrap value of its fleet.

Deleveraging has lowered the cash breakeven level to $16,000 per day at the end of Q1. However, after the Q1 report announcement, STNG received approval from majority lenders under its 2023 $1.0 Billion Credit Facility to make an unscheduled repayment on the term portion of this credit facility in June 2024 of $223.6 million. This will effectively reduce cash break evens by $3,500 per day, to $12,500, meaning that the company, at TCE rates around $40,000 per day, will generate significant amounts of cash for the rest of the year, with over $1 billion in FCF. This could enable significant share repurchases and potential dividend increases. Also, for each $10,000/day increase in average daily rates, this will add ~$336 million of incremental annualized cash flow.

Two non-negligible risks

The primary risks to a long position in STNG include the resolution of geopolitical conflicts reducing ton-mile demand and an increase in the fleet size due to newbuilds.

The product tanker order book as a percentage of the total fleet stands at 12%, indicating significant new supply entering the market. However, the average market fleet age of 13 years suggests that scrapping activities will help offset fleet growth. Product Tanker Fleet Growth is expected at 2.2-2.6% in 2025e and 3.4-3.7% in 2026e.

While some weakness should be expected in the LR2 market, STNG management has also suggested that some LR2 new builds could end up as Aframax tankers, easing this pressure.

CF supportive of further revaluation but timing could be better

STNG's NAV per share should be around $84 per share, meaning that it now approaches 1x NAV and 5x FCF. We assume a constant share count and a quarterly dividend per share of $0.40, totalling dividends at around $80m per year.

The company is positioned favorably with a young fleet (average age of 8 years), and about 77% of its fleet is scrubber-fitted. As STNG achieves its debt reduction targets, we should see both some further multiple expansion and increased shareholder returns. The expected cash generation in 2024 could easily support a market value of $5 billion, translating to approximately $97/share, with a bull case scenario up to $110/share.

Despite the risks, STNG is well-positioned to benefit from ongoing market dynamics. The company's focus on deleveraging and strategic capital allocation supports its robust financial outlook.

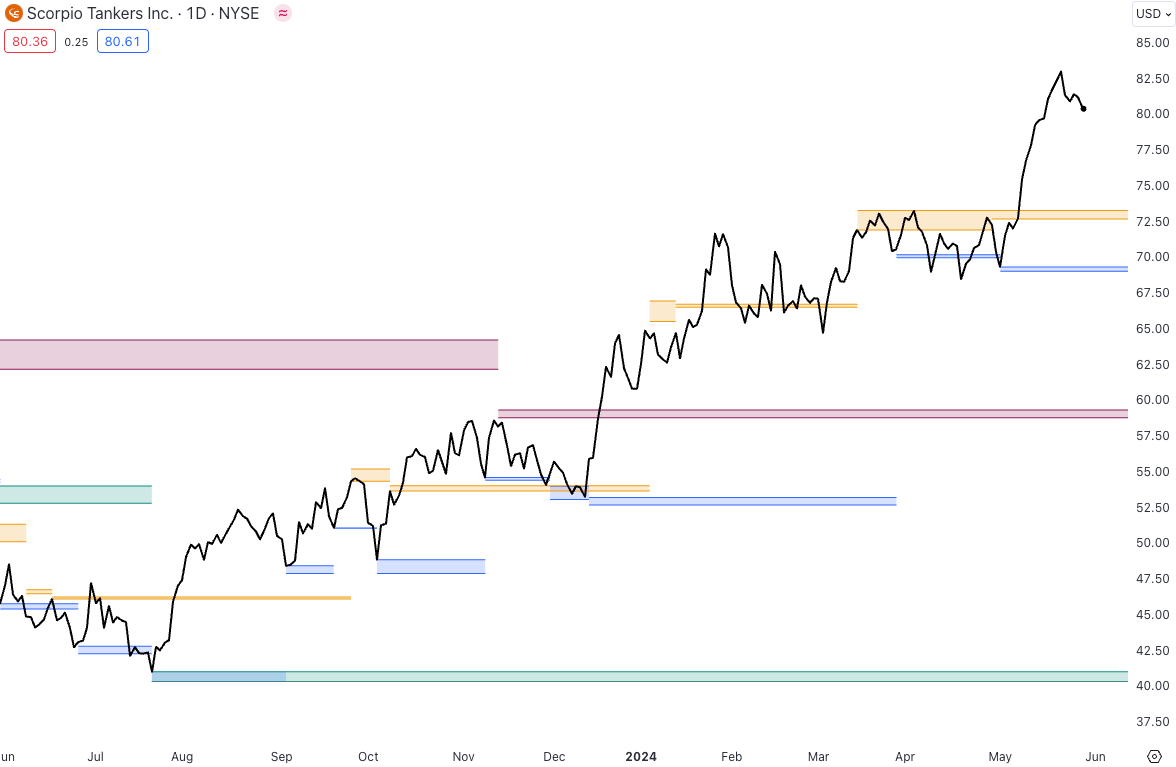

Share price is now up 29% YTD and close to 70% in the past year. So technically timing could be better, and ideally it would be best to await a retest of the $72-73 level before getting long. Given the strong price action to date, we expect some profit taking and take half a position now and take our chances that we'll get in with a full position closer to that level. Either way, STNG belongs at the top of the watchlist.